Predict High Growth Customer

Predict High Growth Customer

In this document, following two problem will be addressed.

Problems: -

- How would you propose segmenting users in ways that can be useful for Sales, Product, and other teams?

- Using that segmentation, how would you identify and predict high growth customer (customer that we expect to significantly increase their transaction volume in the near future and become top users)? Please produce an actual prediction of high growth customer.

Imports

Libraries used for solving the problem: -

- Python 3

- scikit-learn, imblearn (for segmentation and prediction)

- matplotlib, mpl_toolkits, seaborn (for visualization)

import pandas as pd

import numpy as np

import dateutil

from datetime import datetime

#import visualization tools

import seaborn as sns

import matplotlib.pyplot as plt

import matplotlib as mat

from mpl_toolkits.mplot3d import Axes3D

#import scikit-learn library

from sklearn import preprocessing

from sklearn.model_selection import train_test_split

from sklearn.model_selection import cross_val_predict

from imblearn.over_sampling import SMOTE

from sklearn import metrics

from sklearn.decomposition import PCA

from sklearn import cluster

from sklearn.cluster import KMeans

from sklearn import linear_model

from sklearn.linear_model import LogisticRegression

from sklearn.ensemble import RandomForestClassifier

from sklearn import svm

from sklearn.tree import DecisionTreeClassifier

Read Data

Read data from csv file.

#read data from file

raw_data = pd.read_csv('customer.csv')

#Look at the data

print(raw_data.head())

#check for null or mission value

print("\n\nNull/Misisng Data :\n" , raw_data.isnull().sum())

print("\n\nTotal Transaction: ", len(raw_data))

print("Total Users: ", len(set(raw_data.user)))

user time \

0 00038f0484334ac047449166cfbbf6452b31c85c 2016-02-19T23:39:56.925Z

1 00038f0484334ac047449166cfbbf6452b31c85c 2016-02-19T23:41:47.026Z

2 00038f0484334ac047449166cfbbf6452b31c85c 2016-02-23T15:19:54.836Z

3 00038f0484334ac047449166cfbbf6452b31c85c 2016-02-23T15:21:08.273Z

4 00038f0484334ac047449166cfbbf6452b31c85c 2016-02-24T15:19:39.386Z

amount_in_cents

0 1203

1 1203

2 2405

3 2405

4 1203

Null/Misisng Data :

user 0

time 0

amount_in_cents 0

dtype: int64

Total Transaction: 299999

Total Users: 2292

Understanding the data

From initial observation, we see that there is total 299,999 transactions done by 2292 users/merchants. Looking furthermore, there are only three fields: user, time and amount_in_cents. We only have the purchase history (when and how much did they spent). This data can be considered as the behavioral data as it gives the spending habit of the users.

User Segmentation

One of the popular customer segmentation methods to analyze customer behavior is RFM analysis (usually used as a marketing model).

RFM Analysis

RFM stands for Recency, Frequency, and Monetary value (how recently, how often and how much did they buy). These RFM metrics are important indicators of a user’s behavior because the frequency and monetary value affects a user’s lifetime value, and recency affects retention, a measure of engagement.

RFM factors illustrate these facts:

- Recency (R) : Who have purchased recently? Number of days since last purchase (least recency)

- Frequency (F) : Who has purchased frequently? It means the total number of purchases. ( high frequency)

- Monetary Value (M) : Who have high purchase amount? It means the total money customer spent (high monetary value)

Each of the three variables(Recency, Frequency, and Monetary) usually consist of four equal groups, which creates 64 (4x4x4) different customer segments. However, handling 64 segments is cumbersome, so we will reduce it to 7 important segments as follows: -

| Segements | RFM | Description | Marketing Strategy |

|---|---|---|---|

| Best Customer | 111 | Bought most recently most often spend the most |

No price incentives new products loyalty programs Free marketing tools |

| New Customer | 1xx | Buy one time & haven’t lost | Aggressive marketing |

| Loyal Customer | x1x | Bought most frequently | Build long term relationship |

| Big Spenders | xx1 | Spend the most | Market your most expensive products |

| Almost Lost | 211 | Haven’t purchased for some time, but purchased frequently and spend the most | Aggressive price incentives |

| Lost Customers | 311 | Haven’t purchased for some time, but purchased frequently and spend the most | Aggressive price incentives |

| Cheap Lost | 3xx | Last purchased long ago, purchased few, and spent little | Never Mind |

Data Preprocessing

As we are trying to segments the users based on RFM, let us group the data by users and generate RFM metrics.

- Recency: - Day since the last transaction

- Frequency: - Total number of transcations since the beginning

- Monetary:- Sum of amount_in_cent for the user (total amount spent by the user)

Steps of RFM(Recency, Frequency, Monetary):

- Calculate the Recency, Frequency, Monetary values for each customer.

- Add segment bin values to RFM table using manually defined threshold (usually quartiles).

- Sort the customer RFM score in ascending order.

Step 1 Calculate the Recency, Frequency, Monetary values

#get transaction date

transaction = raw_data

transaction['time'] = pd.to_datetime(transaction['time'])

today = datetime.now()

#Get Days since Recent Transaction (recency), Frequency of transaction and Amount spent per Seller

transaction= transaction.groupby('user').agg({'time': lambda date: (today - date.max()).days, 'user':['count'], 'amount_in_cents': ['sum'] }).reset_index()

transaction.columns = ['user','recency','frequency','monetary']

print("Total Users: ", len(transaction))

print("\n\nData Description: \n", transaction.describe())

Total Users: 2292

Data Description:

recency frequency monetary

count 2292.000000 2292.000000 2.292000e+03

mean 857.890489 130.889616 2.276053e+06

std 175.071516 872.881742 2.333995e+07

min 531.000000 1.000000 0.000000e+00

25% 722.000000 2.000000 1.367900e+04

50% 854.000000 8.000000 8.502450e+04

75% 983.000000 37.000000 5.709650e+05

max 1260.000000 32725.000000 9.650335e+08

Step 2 Add segment bin values to RFM table using quartile.

- Function to calculate rank for each metrics

- Function to define segment based on rfm value

# get rank for each metrics

def rank_r(x, p, t):

if x <= t[p][0.25]:

return str(1)

elif x <= t[p][0.75]:

return str(2)

else:

return str(3)

def rank_f(x, p, t):

if x <= t[p][0.75]:

return str(3)

else:

return str(1)

def rank_m(x, p, t):

if x <= t[p][0.25]:

return str(3)

elif x <= t[p][0.75]:

return str(2)

else:

return str(1)

def define_rfm_segment(rows):

if rows['rfm_score'] == '111':

return 'best_users'

elif rows['rfm_score'] == '211':

return 'almost_lost'

elif rows['rfm_score'] == '311':

return 'lost_users'

elif rows['rank_r'] == '3':

return 'cheap_lost'

elif rows['rank_f'] == '1':

return 'loyal_users'

elif rows['rank_m'] == '1':

return 'big_spender'

elif rows['rank_f'] == '3':

return 'new_customer'

else:

return rows['rfm_score']

Step 2 contd…

- Calculate threshold for the segment bin

- Get rank for each metric based on the threshold

- Merge rank score to get rfm score

- Finally, define segments based on rfm score

- Print high-value customers (that bought recently, buys frequently and buy high-value items)

# Use 25 and 75th quantile to get rank for R, F and M ----

threshold = transaction.drop('user', axis=1).quantile(q=[0.25, 0.75])

threshold = threshold.to_dict()

transaction['rank_r'] = transaction['recency'].apply(rank_r, args=('recency', threshold))

transaction['rank_f'] = transaction['frequency'].apply(rank_f, args=('frequency', threshold))

transaction['rank_m'] = transaction['monetary'].apply(rank_m, args=('monetary', threshold))

transaction['rfm_score'] = transaction['rank_r'] + transaction['rank_f']+transaction['rank_m']

#Define segment based on RFM score

transaction['segment'] = transaction.apply(define_rfm_segment, axis =1)

Visualize the user segments

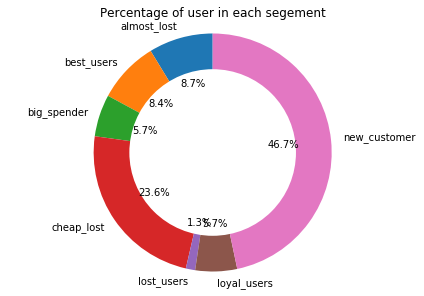

The following pie-charts shows the percentage of users in each segments.

transaction_count = transaction.groupby('segment').agg({'user':['count'],'monetary':['sum']}).reset_index()

transaction_count.columns = ['segment','user','amount']

transaction_count[['amount']] = transaction_count[['amount']]/100

fig1, ax1 = plt.subplots()

ax1.pie(data=transaction_count, x='user', labels='segment', autopct='%1.1f%%', startangle=90)

#draw circle

centre_circle = plt.Circle((0,0),0.70,fc='white')

fig = plt.gcf()

fig.gca().add_artist(centre_circle)

# Equal aspect ratio ensures that pie is drawn as a circle

ax1.axis('equal')

plt.tight_layout()

plt.title("Percentage of user in each segement")

plt.show()

Visualize the user segments

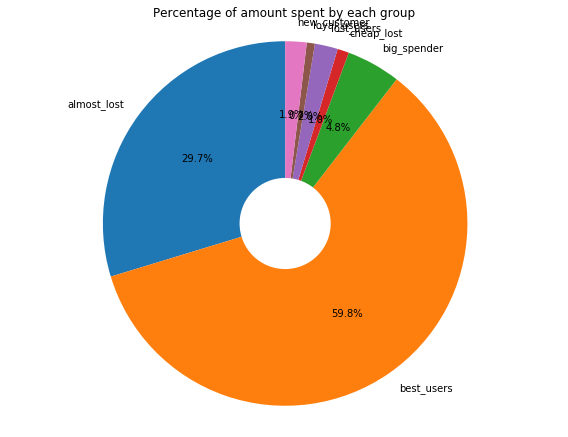

The following pie-charts shows the percentage of the amount spent by each segments of the users. From above pie-chart we see that only 8.6% of the user belongs to best_customer category. However, they spend almost 48%.

One more point to notice, if we combine almost lost and best customer it accounts around 17% of the total users. And if we combine the amount spend by those two group it accounts for almost 88% of total transaction volume. This 17% user to 88% transaction volume is almost close to 80/20 rule (also known as the Pareto Principle :- 80% of the results generally come from 20% of the causes). In this context, it implies that ~80% of transcation volume would be produced by the top ~20% of customers. Also, In our case, this rule somewhat satisfies. Therefore, sales and marketing team should foucs their attention in retaining almost lost customer.

fig1, ax1 = plt.subplots(figsize=(8, 6))

ax1.pie(data=transaction_count, x='amount', labels='segment', autopct='%1.1f%%', startangle=90)

#draw circle

centre_circle = plt.Circle((0,0),0.25,fc='white')

fig = plt.gcf()

fig.gca().add_artist(centre_circle)

# Equal aspect ratio ensures that pie is drawn as a circle

ax1.axis('equal')

plt.tight_layout()

plt.title("Percentage of amount spent by each group")

plt.show()

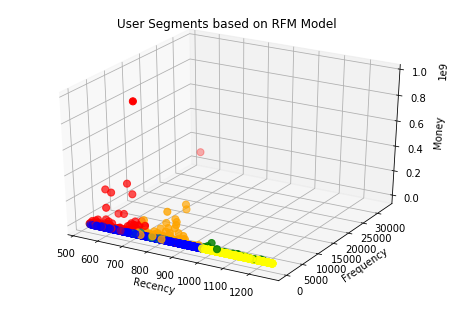

Visualizing scatter plot

The scatter plot shows the user segment. As we see in the scatter plot, the red cluster has the least recency, high monetary and also high frequency to blue and yellow cluster so it refer the best user segments.

segment = {'best_users':0, 'lost_users':1, 'new_customer':2, 'loyal_users':3, 'cheap_lost':4, 'big_spender':5, 'almost_lost':6}

label = [segment[item]for item in transaction['segment']]

fig = plt.figure()

ax = fig.gca(projection='3d')

ax = Axes3D(fig)

colors = ['red','green','blue','purple', 'yellow','teal','orange']

ax.scatter(transaction['recency'], transaction['frequency'], transaction['monetary'], c=label, s=50, cmap=mat.colors.ListedColormap(colors))

ax.set_xlabel('Recency', rotation=150)

ax.set_ylabel('Frequency')

ax.set_zlabel('Money', rotation=60)

plt.title('User Segments based on RFM Model')

plt.show()

Users Segments and their usefulness to the business departments

Each of the above segments is useful for various department of the company. Following table summarizes how each segment can be useful.

| ’#’ | Segment | Department | Usefulness |

|---|---|---|---|

| 1. | Best Customer | Sales/Product | Make new product and sale it to them |

| 2. | New Customer | Marketing | Try to introduce the loyalty program. Make sure their initial experience with your product and service is pleasant and memorable so they buy again. Sending educational content. |

| 3. | Loyal Customer | Product | Can contact loyal customers even before building a product. They can provide you great insights into what to build and how to promote it. This group of people will also happily refer the product to their circles of influence. |

| 4. | Big Spenders | Marketing | Market your most expensive products |

| 5. | Almost Lost | Sales/Marketing | Send personalized emails or call to reconnect with these customers. Offer purchases at a discount or run surveys to address their concerns. |

| 6. | Lost Customers | Sales/Marketing | Aggressive price incentives to retain them |

| 7. | Cheap Lost | — | You can ignore them |

Who are high growth merchant (user)?

Based on the above segmentation, segment 1 (Best Customer) buy recently, buy frequently and spends lots of money. So, they have the potential to be high growth merchant. Also, based on the definition of high growth merchant in problem no. 2,(merchants that we expect to significantly increase their transaction volume) segment 4 (Big Spenders) can also be considered high growth merchant because even though they buy less frequently but their transaction have monetary value resulting in higher sales volume.

Therefore, we can assume Best valued users and Big Spenders as High Growth Users because they are the one that bought most recently, buy most often and spend a lot of money.

Now by labeling users belonging to these 2 segments as “high growth customer” and other as “low growth customer”, we can make a labeled dataset for a supervised machine learning model to predict high growing merchant for future.

#function to label each user as high growth or not

def Label_Segments(rows):

if rows['segment'] == 'best_users':

return 1

elif rows['segment'] == 'big_spender':

return 1

else:

return 0

transaction['high_growth'] = transaction.apply(Label_Segments, axis =1)

user_label = transaction[['user', 'high_growth']]

High Growth Users

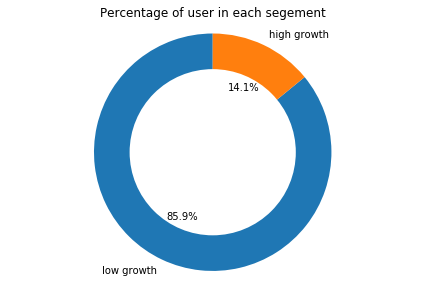

Let’s check how many users have high growth? Here, you can plot a pie chart using Matplotlib. Around 14% of the user is high growth users.

growth_count=transaction.groupby('high_growth').agg({'user':['count'],'monetary':['sum']}).reset_index()

growth_count.columns = ['segment','user','amount']

growth_count.loc[growth_count['segment']==0, 'segment'] ='low growth'

growth_count.loc[growth_count['segment']==1, 'segment'] ='high growth'

fig1, ax1 = plt.subplots()

ax1.pie(data=growth_count, x='user', labels='segment', autopct='%1.1f%%', startangle=90)

centre_circle = plt.Circle((0,0),0.70,fc='white')

fig = plt.gcf()

fig.gca().add_artist(centre_circle)

# Equal aspect ratio ensures that pie is drawn as a circle

ax1.axis('equal')

plt.tight_layout()

plt.title("Percentage of user in each segement")

plt.show()

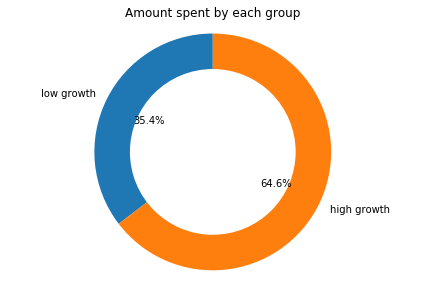

Amount Spent by High Growth Users

Though, there are only 14.1 high growth user, they account for around 53% of the total transaction volume.

fig1, ax1 = plt.subplots()

ax1.pie(data=growth_count, x='amount', labels='segment', autopct='%1.1f%%', startangle=90)

#draw circle

centre_circle = plt.Circle((0,0),0.70,fc='white')

fig = plt.gcf()

fig.gca().add_artist(centre_circle)

# Equal aspect ratio ensures that pie is drawn as a circle

ax1.axis('equal')

plt.tight_layout()

plt.title("Amount spent by each group")

plt.show()

### Feature Generation for Prediction

For predicting users that are potentially high growth users using supervised machine learning model, let us generate some features.

$1.$ First we divide time into Year and Month

$2.$ We will generate recency, frequency (total transaction), and monetary (total amt in cent) as before. Also, we will generate mean amount and max amount per year.

$3.$ We will find how long the user has been the customer and use it as a feature called cust_dur.

$4.$ There might be some seasonal behavior. Therefore, we will calculate the count and amt per month and merge them into 4 seasons.

$5.$ As we are looking to predict high growth merchant, we would like to see the difference in amount spent by the merchant in their first year in comparison to the recent year. This might give us an indication of how the merchant is spending (either spending more or less).

Step 1, 2, 3

user_data = raw_data

#convert time in datetime

user_data['time'] = pd.to_datetime(user_data['time'])

#convert amount into dollar

user_data['amount_in_cents'] = user_data['amount_in_cents']

today = datetime.now()

user_data['year'] = raw_data['time'].apply(lambda x: x.year)

user_data['month'] = raw_data['time'].apply(lambda x: x.month)

user_data['day_since'] = raw_data['time'].apply(lambda x: (today-x).days)

user_data = raw_data[['user','time','amount_in_cents', 'year', 'month', 'day_since']]

dataset_year = raw_data.groupby('user')['year','amount_in_cents'].agg({'year':['min','max'], 'amount_in_cents':['sum','mean','count','max'],'day_since':['max'], 'time': lambda date: (today - date.max()).days}).reset_index()

dataset_year.columns = ['user', 'since', 'till', 'monetary', 'mean', 'frequency','max','cust_dur','recency']

print("Total User: ", len(dataset_year))

#print(dataset_year.head())

Total User: 2292

Step 4:- Get transaction count and amout per month. and merge them into 4 season

#get transaction count per month

dataset_mcount = user_data.groupby(['user','month']).size().reset_index()

dataset_mcount.columns = ['user', 'month','count']

dataset_mcount = dataset_mcount.pivot(index = 'user', columns='month', values='count')

dataset_mcount.columns = ['m{:d}c'.format(col) for col in dataset_mcount.columns]

dataset_mcount = dataset_mcount.reset_index()

#get transaction Amt per month

dataset_mamt = user_data.groupby(['user','month']).agg({'amount_in_cents':['sum']}).reset_index()

dataset_mamt.columns = ['user', 'month','amt']

dataset_mamt = dataset_mamt.pivot(index = 'user', columns='month', values='amt')

dataset_mamt.columns = ['m{:d}a'.format(col) for col in dataset_mamt.columns]

dataset_mamt = dataset_mamt.reset_index()

#Merge all into one data frame

header = ['user', 'since', 'till', 'cust_dur', 'monetary', 'mean', 'frequency', 'max', 'recency','m1c', 'm2c', 'm3c',

'm4c', 'm5c', 'm6c','m7c', 'm8c', 'm9c','m10c', 'm11c', 'm12c', 'm1a', 'm2a', 'm3a',

'm4a', 'm5a', 'm6a','m7a', 'm8a', 'm9a','m10a', 'm11a', 'm12a']

final_dataset = pd.DataFrame(index=range(0, len(dataset_year)), columns = header)

final_dataset = final_dataset.fillna(dataset_year)

final_dataset = final_dataset.fillna(dataset_mcount)

final_dataset = final_dataset.fillna(dataset_mamt)

final_dataset = final_dataset.fillna(0)

#Now combine months data to season

#Get seasonal count

final_dataset['spring_count'] = final_dataset['m1c']+final_dataset['m2c']+final_dataset['m3c']

final_dataset['summer_count'] = final_dataset['m4c']+final_dataset['m5c']+final_dataset['m6c']

final_dataset['fall_count'] = final_dataset['m7c']+final_dataset['m8c']+final_dataset['m9c']

final_dataset['winter_count'] = final_dataset['m10c']+final_dataset['m11c']+final_dataset['m12c']

final_dataset['spring_amt'] = final_dataset['m1a']+final_dataset['m2a']+final_dataset['m3a']

final_dataset['summer_amt'] = final_dataset['m4a']+final_dataset['m5a']+final_dataset['m6a']

final_dataset['fall_amt'] = final_dataset['m7a']+final_dataset['m8a']+final_dataset['m9a']

final_dataset['winter_amt'] = final_dataset['m10a']+final_dataset['m11a']+final_dataset['m12a']

final_dataset = final_dataset[['user', 'cust_dur', 'monetary', 'mean', 'frequency', 'max','recency','spring_count', 'summer_count', 'fall_count','winter_count','spring_amt','summer_amt','fall_amt','winter_amt']]

print("Total User: ", len(final_dataset))

#print(final_dataset.head())

Total User: 2292

Step 5:

user_year = user_data.groupby(['user', 'year'])['amount_in_cents'].sum().reset_index()

user_year.columns = ['user','year','amount']

#print(user_year.head(20))

user_year['sales_growth'] = user_year['amount'].diff() #(user_year['amount'].diff()/user_year['amount'].shift(1))*100

user_year.loc[user_year.user != user_year.user.shift(1), 'sales_growth'] = 0

user_year = user_year.groupby(['user'])['sales_growth'].sum().reset_index()

#print(user_year.head(20))

#merge sales growth in the final dataset

final_dataset = final_dataset.merge(user_year)

print("Total User: ", len(final_dataset))

#print(final_dataset.head())

Total User: 2292

Use RFM Cluster Label for High Growth Merchant

#print(user_label)

final_dataset = final_dataset.merge(user_label)

#print(final_dataset.head())

Final Dataset

final_dataset.describe()

| cust_dur | monetary | mean | frequency | max | recency | spring_count | summer_count | fall_count | winter_count | spring_amt | summer_amt | fall_amt | winter_amt | sales_growth | high_growth | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 2292.000000 | 2.292000e+03 | 2.292000e+03 | 2292.000000 | 2.292000e+03 | 2292.000000 | 2292.000000 | 2292.000000 | 2292.000000 | 2292.000000 | 2.292000e+03 | 2.292000e+03 | 2.292000e+03 | 2.292000e+03 | 2.292000e+03 | 2292.000000 |

| mean | 1012.296684 | 2.276053e+06 | 2.542124e+04 | 130.889616 | 9.380183e+04 | 857.890925 | 30.511344 | 29.005672 | 27.512653 | 43.859948 | 5.494276e+05 | 5.743619e+05 | 5.512233e+05 | 6.010400e+05 | 1.413506e+05 | 0.140925 |

| std | 133.542412 | 2.333995e+07 | 7.985656e+04 | 872.881742 | 3.211533e+05 | 175.072410 | 189.035657 | 172.670229 | 138.929870 | 490.979465 | 7.323547e+06 | 5.684370e+06 | 5.430441e+06 | 6.059076e+06 | 7.372282e+06 | 0.348020 |

| min | 550.000000 | 0.000000e+00 | 0.000000e+00 | 1.000000 | 0.000000e+00 | 531.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | -1.628096e+08 | 0.000000 |

| 25% | 921.000000 | 1.367900e+04 | 3.487950e+03 | 2.000000 | 5.893000e+03 | 722.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000 |

| 50% | 1011.500000 | 8.502450e+04 | 7.666419e+03 | 8.000000 | 1.918150e+04 | 854.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 4.450000e+03 | 4.810000e+03 | 4.690000e+03 | 6.795500e+03 | 0.000000e+00 | 0.000000 |

| 75% | 1116.250000 | 5.709650e+05 | 1.992638e+04 | 37.000000 | 6.013000e+04 | 983.000000 | 7.000000 | 7.000000 | 7.000000 | 9.000000 | 8.733925e+04 | 8.811825e+04 | 8.511125e+04 | 9.975200e+04 | 0.000000e+00 | 0.000000 |

| max | 1260.000000 | 9.650335e+08 | 2.281332e+06 | 32725.000000 | 6.013000e+06 | 1260.000000 | 5179.000000 | 5502.000000 | 2791.000000 | 21636.000000 | 3.235230e+08 | 1.979841e+08 | 1.960534e+08 | 2.474730e+08 | 1.534244e+08 | 1.000000 |

Predicting High Growth Merchant

Here, we are going to predict High Growth Merchant using Logistic Regression. To understand the model performance, dividing the dataset into a training set and a test set is a good strategy. The dataset is broken into two parts in the ratio of 70:30. It means 70% of the data will be used for model training and 30% for model testing.

Starting with the above-generated sets of feature let’s see how logistic regression would perform for predicting high growth merchants. Here we will do the following:-

- We scale (normalize) the data

- We split data into train and test set (70-30%)

- We use logistic regression and check training and test accuracy

#Function to print result of the classifier

def print_result(y_test, y_pred):

target_names = ['Low Growth', 'High Growth']

print(metrics.classification_report(y_test, y_pred, target_names=target_names))

print("Confusion Matrix: \n", metrics.confusion_matrix(y_test, y_pred))

X = final_dataset.drop(columns=['user','high_growth'])

X = preprocessing.scale(X)

y = final_dataset['high_growth']

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=42) # 70% training and 30% test

print("\n\nLogistic Regression...")

log = linear_model.LogisticRegression(solver = 'liblinear')

log.fit(X_train, y_train)

#check if the model is correct in train data

print("\n\nTraining")

y_pred = log.predict(X_train)

print_result(y_train, y_pred)

print("\n\nTesting")

#now predict on test data

y_pred = log.predict(X_test)

print_result(y_test, y_pred)

Logistic Regression...

Training

precision recall f1-score support

Low Growth 0.92 0.98 0.95 1383

High Growth 0.83 0.48 0.61 221

micro avg 0.92 0.92 0.92 1604

macro avg 0.88 0.73 0.78 1604

weighted avg 0.91 0.92 0.91 1604

Confusion Matrix:

[[1361 22]

[ 114 107]]

Testing

precision recall f1-score support

Low Growth 0.91 0.98 0.94 586

High Growth 0.79 0.41 0.54 102

micro avg 0.90 0.90 0.90 688

macro avg 0.85 0.70 0.74 688

weighted avg 0.89 0.90 0.88 688

Confusion Matrix:

[[575 11]

[ 60 42]]

/Library/Frameworks/Python.framework/Versions/3.6/lib/python3.6/site-packages/ipykernel_launcher.py:8: DataConversionWarning: Data with input dtype int64, float64 were all converted to float64 by the scale function.

From above, we see that our model have decent performance predicting low growth merchant. However, for high growth merchant, the performance is low.

So, to make sure that we are not overfitting the model and are using essential/good features, let us do some feature selection.

Feature Selection

Feature Selection is the process of selecting the attributes that can make the predicted variable more accurate or eliminating those attributes that are irrelevant and can decrease the model accuracy and quality.

Data and feature correlation is considered one of the important step in the feature selection phase of the data pre-processing especially if the data type for the features is continuous.

Data Correlation helps to understand the relationship between multiple variables and attributes in the dataset. Using Correlation, you can get some insights such as:

- One or multiple attributes depend on another attribute or a cause for another attribute.

- One or multiple attributes are associated with other attributes.

def correlation_heatmap(final_dataset):

correlations = final_dataset.corr()

fig, ax = plt.subplots(figsize=(10,10))

sns.heatmap(correlations, vmax=1.0, center=0, fmt='.2f',

square=True, linewidths=.5, annot=True, cbar_kws={"shrink": .70})

plt.show();

correlation_heatmap(final_dataset)

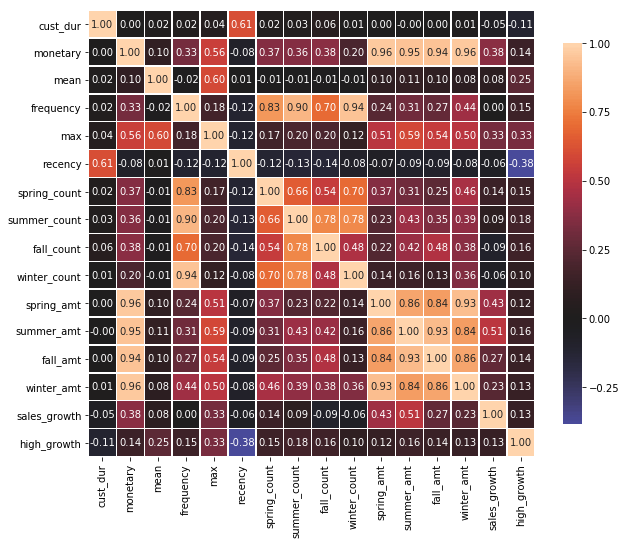

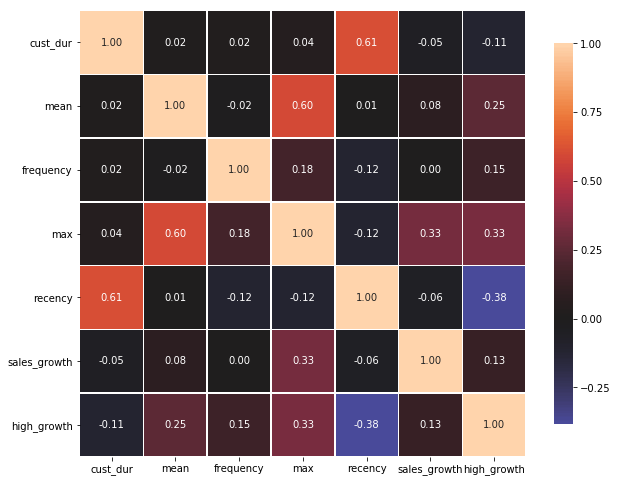

As we can see in the above matrix, there is a high correlation between monetary -> seasonal amt and frequency -> seasonal count. It is understandable as we generate these seasonal features by breaking down the monetary and frequency. Also, the correlation is between frequency -> monetary and mean -> max. So, we will remove one feature from each correlation set that have correlation value of more than 65%.

Also, another striking fact is that recency has a negative correlation with high_growth. We can see that higher the value of recently then a chance of high growth is low (i.e these users are lost or about to be lost)

selected_feature = final_dataset.drop(columns=['monetary','fall_count','spring_count','summer_count','winter_count','spring_amt','summer_amt','winter_amt','fall_amt'])

correlation_heatmap(selected_feature)

Prediction Model

Now, using the remaining features let’s do prediction using Logistic Regression again.

X = selected_feature.drop(columns =['user','high_growth'])

y = selected_feature['high_growth']

X = preprocessing.scale(X)

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=42) # 70% training and 30% test

print("\n\nLogistic Regression...")

log = linear_model.LogisticRegression(solver = 'liblinear')

log.fit(X_train, y_train)

#check if the model is correct in train data

print("Training\n\n")

y_pred = log.predict(X_train)

print_result(y_train, y_pred)

print("Testing\n\n")

#now predict on test data

y_pred = log.predict(X_test)

print_result(y_test, y_pred)

Logistic Regression...

Training

precision recall f1-score support

Low Growth 0.92 0.98 0.95 1383

High Growth 0.82 0.48 0.61 221

micro avg 0.91 0.91 0.91 1604

macro avg 0.87 0.73 0.78 1604

weighted avg 0.91 0.91 0.90 1604

Confusion Matrix:

[[1360 23]

[ 115 106]]

Testing

precision recall f1-score support

Low Growth 0.90 0.99 0.94 586

High Growth 0.83 0.39 0.53 102

micro avg 0.90 0.90 0.90 688

macro avg 0.87 0.69 0.74 688

weighted avg 0.89 0.90 0.88 688

Confusion Matrix:

[[578 8]

[ 62 40]]

/Library/Frameworks/Python.framework/Versions/3.6/lib/python3.6/site-packages/ipykernel_launcher.py:3: DataConversionWarning: Data with input dtype int64, float64 were all converted to float64 by the scale function.

This is separate from the ipykernel package so we can avoid doing imports until

By reducing feature set, there was little/no effect in the model performance. Therefore, we can ignore all those seasonal features for good.

Using Cross-Validation

To make sure our model is not overfitted, let us try 10-fold cross-validation.

X = selected_feature.drop(columns =['user','high_growth'])

y = selected_feature['high_growth']

X = preprocessing.scale(X)

log = linear_model.LogisticRegression(solver = 'liblinear')

y_pred = cross_val_predict(log, X, y, cv=10)

print("\n\nLogistic Regression...\n\n")

print_result(y,y_pred)

/Library/Frameworks/Python.framework/Versions/3.6/lib/python3.6/site-packages/ipykernel_launcher.py:3: DataConversionWarning: Data with input dtype int64, float64 were all converted to float64 by the scale function.

This is separate from the ipykernel package so we can avoid doing imports until

Logistic Regression...

precision recall f1-score support

Low Growth 0.91 0.98 0.95 1969

High Growth 0.79 0.44 0.56 323

micro avg 0.90 0.90 0.90 2292

macro avg 0.85 0.71 0.75 2292

weighted avg 0.90 0.90 0.89 2292

Confusion Matrix:

[[1932 37]

[ 182 141]]

Again, using 10-fold cross validation, there was little/no effect in the model performance.

Imbalance Nature of the Data

After feature selection and using cross-validation also, our prediction performance for High Growth Merchant did not improve significantly. One potential reason for this is the imbalance nature of the data (High growth to low growth ratio is ~3:20).

In supervised learning, a common strategy to overcome the class imbalance problem is to resample the original training dataset to decrease the overall level of class imbalance. Resampling is done either by oversampling the minority (positive) class and/or under-sampling the majority (negative) class until the classes are approximately equally represented.

Before going to different re-sampling techniques one most important thing to keep in mind is that all resampling operations have to be applied to only training datasets. If upsampling is done before splitting the dataset into a train and validation set, then it could end up with the same observation in both datasets. As a result, a machine learning model will be able to perfectly predict the value for those observations when predicting on the validation set, hence inflating the accuracy and recall.

Even though undersampling and oversampling approaches address the class imbalance problem, they also suffer some drawbacks. The random undersampling method can potentially remove certain important data points, and random oversampling can lead to overfitting. SMOTE can avoid this pitfall.

SMOTE: Synthetic Minority Over-sampling Technique

SMOTE has been designed to generate new samples that are coherent with the minor class distribution. The main idea is to consider the relationships that exist between samples and create new synthetic points along the segments connecting a group of neighbors. We will oversample minority class (high growth merchant) using SMOTE technique.

sm = SMOTE(random_state=12)

X = selected_feature.drop(columns=['user','high_growth'])

y = final_dataset['high_growth']

X = preprocessing.scale(X)

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=42) # 70% training and 30% test

#oversample the training set

x_train_res, y_train_res = sm.fit_sample(X_train, y_train)

x_test_res, y_test_res = sm.fit_sample(X_test, y_test)

print (y_train.value_counts())

print("New Data", np.bincount(y_train_res))

print("\n\nLogistic Regression...")

log = linear_model.LogisticRegression(solver='liblinear')

log.fit(x_train_res, y_train_res)

#check if the model is correct in train data

print("\n\nTraining")

y_pred = log.predict(x_train_res)

print_result(y_train_res, y_pred)

print("\n\nTesting")

#now predict on test data

y_pred = log.predict(X_test)

print_result(y_test, y_pred)

/Library/Frameworks/Python.framework/Versions/3.6/lib/python3.6/site-packages/ipykernel_launcher.py:6: DataConversionWarning: Data with input dtype int64, float64 were all converted to float64 by the scale function.

0 1383

1 221

Name: high_growth, dtype: int64

New Data [1383 1383]

Logistic Regression...

Training

precision recall f1-score support

Low Growth 0.88 0.84 0.86 1383

High Growth 0.85 0.89 0.87 1383

micro avg 0.87 0.87 0.87 2766

macro avg 0.87 0.87 0.87 2766

weighted avg 0.87 0.87 0.87 2766

Confusion Matrix:

[[1163 220]

[ 153 1230]]

Testing

precision recall f1-score support

Low Growth 0.98 0.85 0.91 586

High Growth 0.51 0.90 0.65 102

micro avg 0.85 0.85 0.85 688

macro avg 0.74 0.87 0.78 688

weighted avg 0.91 0.85 0.87 688

Confusion Matrix:

[[496 90]

[ 10 92]]

Using SMOTE in training data, the recall for minority class (High Growth) for the test case is increase up to 87% from 46% and Also the F1-Score improved to 63% from 51%.

Now, let us try several other algorithms and see their performance. We will use the following three algorithm with 10-fold cross validation.

- Decision Tree

- Random Forest

- SVM

X = selected_feature.drop(columns=['user','high_growth'])

y = final_dataset['high_growth']

#X = preprocessing.scale(X)

decision_tree_classifier = DecisionTreeClassifier()

y_pred = cross_val_predict(decision_tree_classifier, X, y, cv=10)

print("\n\nDecision Tree...")

print_result(y,y_pred)

random_forest_classifier = RandomForestClassifier(n_estimators=10, criterion="entropy")

y_pred_rf = cross_val_predict(random_forest_classifier, X, y, cv=10)

print("\n\nRandom Forest...")

print_result(y, y_pred_rf)

svm_classifier = svm.SVC(kernel="linear")

y_pred = cross_val_predict(svm_classifier, X, y, cv=10)

print("\n\nSVM ...")

print_result(y,y_pred)

Decision Tree...

precision recall f1-score support

Low Growth 0.98 0.99 0.99 1969

High Growth 0.92 0.90 0.91 323

micro avg 0.97 0.97 0.97 2292

macro avg 0.95 0.95 0.95 2292

weighted avg 0.97 0.97 0.97 2292

Confusion Matrix:

[[1942 27]

[ 31 292]]

Random Forest...

precision recall f1-score support

Low Growth 0.98 0.99 0.99 1969

High Growth 0.93 0.88 0.91 323

micro avg 0.97 0.97 0.97 2292

macro avg 0.96 0.93 0.95 2292

weighted avg 0.97 0.97 0.97 2292

Confusion Matrix:

[[1949 20]

[ 39 284]]

Prediction Results

Here, we have summerized the results of classification algorithms for predicting high growth merchants.

| Algorithm | Precision | Recall | F1-Score | |

|---|---|---|---|---|

| Logistic Regression (using SMOTE) | 0.90 | 0.85 | 0.86 | |

| Decision Tree | .98 | 0.98 | 0.98 | |

| Random Forest | 0.99 | 0.99 | 0.99 | |

| SVM | 0.88 | 0.89 | 0.87 |

Random Forest gave the best performance, understandbly so given that random forest is ensemble technique.

List of High Growth Merchants

Since Random Forest gave the best recall and precision, the list of high growth merchant predicted by random forest is given below:-

The list is saved in CSV file name “high_growth_merchant.csv” and is attached in the submission folder.

final_dataset['predicted'] = y_pred_rf

high_growth_merchant = final_dataset[['user', 'monetary']].loc[final_dataset['predicted']==True]

high_growth_merchant[['user', 'monetary']].sort_values('monetary', ascending=False).to_csv('high_growth_merchant.csv',index=False)

print("High Growth Merchant: \n",high_growth_merchant[['user', 'monetary']].sort_values('monetary', ascending=False))

Future Works

- I would investigate the clustering approach like K-Mean to see if we can get a similar segment for high growth merchants.

- Try to run a few other classification algorithms like neural network and see how they perform.

- I would tune parameters for each algorithm using grid search.